Koinly: Ultimate Crypto Tax Filling Service

Cryptocurrencies are some of the most sought-after assets in the financial sector attracting billions of dollars in investments every year. Retail and institutional investors are investing a great deal in anticipation of bumper returns from some projects with tremendous potential amid the digital revolution.

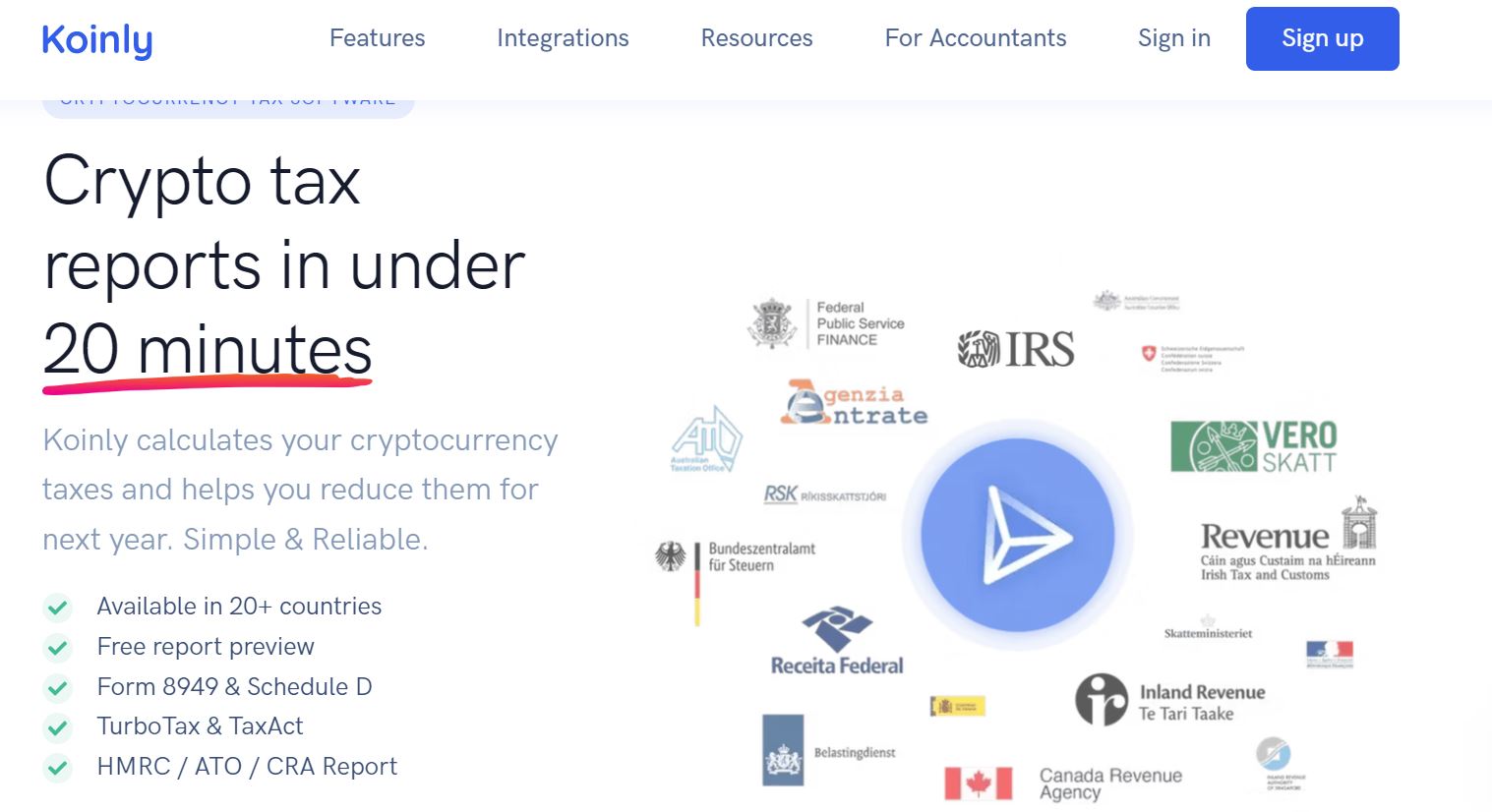

As a growing field of investments, cryptocurrencies are also attracting interest from regulators and agencies for tax purposes. Amid the heightened regulation, Koinly is a new service that seeks to make it easy for people to own, manage and report all their cryptocurrency holdings for tax purposes.

The US Internal Revenue Service and other global tax agencies require people to file tax returns from crypto investments. However, very few people are aware that cryptocurrencies are treated as assets and thus subject to capital gains and income in tax.

What is Koinly

Koinly has built the world’s largest and most efficient cryptocurrency tracker. The system is able to automatically track cryptocurrency holdings and transactions across multiple exchange accounts, wallets, and blockchain platforms. It then aggregates the information collated and generates valuable data and reports used in tax filing in various jurisdictions.

If you intend to file crypto tax returns via an accountant, be ready to answer myriad questions, some of which you might not have answers. Additionally, it is a struggle to report crypto taxes via apps like Turbo Tax and Tax ACTK. Koinly has set out to make it easy for people to track and analyze all their cryptocurrency holdings and transactions all from a single platform.

The game changing crypto tracker, offers integration to over 350 exchanges, 90 wallets, and 150 blockchains. Therefore, it is able to collect all the necessary cryptocurrency transaction history needed to compute cryptocurrency tax. It also offers its service sin more than 20 countries.

In addition to collecting cryptocurrency transaction history, Koinly also tracks all realized and unrealized profits and losses, helping supercharge portfolio performance.

Whether you are an investor looking to get an accurate tax report of all your dealings or a business looking to track all the inventory, Koinly will always have everything covered.

Additionally, it is the best crypto portfolio tracker for viewing total holdings and portfolio growth. Some of the key benefits of using Koinly include:

- Ability to see all return on investment in fiat on all crypto holdings

- Provides a detailed overview of all mining, staking, lending, and other crypto-related income

- It makes it easy to see all the profit/loss and capital gains on a crypto portfolio

Thanks to Koinly, people no longer have to go to different crypto exchanges or wallets to collect the much-needed data needed for tax filing. Instead, its automated data import feature can connect all accounts via an API, collecting data on all transactions.

Whether engaged in the margin or futures trading in various exchanges, it can collect all the information used to generate reports used in tax filing. Additionally, it can collect income from multiple platforms, including staking, airdrops, and DeFi income.

Calculating Crypto Tax

Before any crypto tax is filled with the relevant tax agency, i.e., the IRS, it is important to calculate all the crypto totals. In this case, one should calculate the following:

- Capital gains from crypto

- Capital losses from crypto

- Income from crypto

- Expenses related from crypto investments

Generating crypto reports for tax filing

Koinly has partnerships with tax firms in more than 20 countries to help users generate crucial tax reports. It also relies on artificial intelligence technology to track and detect crypto transfers between various wallets while keeping track of original costs. Regardless of country, it can use multiple cost-basis methods to generate crucial crypto tax reports.

Source: Koinly.io

Some of the crucial crypto tax reports it can generate include:

-

Capital gains & margins trading summary

While crypto transactions in exchanges come with tons of data, Koinly can summarize them. Its financial year tax report only features specific figures needed for tax returns on summarizing all cryptocurrency taxable gains and losses. It also summarizes crypto income including margin trades, options, and futures.

Source: Koinly.io

-

End-of-year valuation report

The End of Year Valuation report details all the crypto holdings at the end of the given financial year. The report makes it easy to see the value of the holdings while also detailing the acquisition costs. Koinly also carries out necessary currency conversion so that the report makes sense depending on the filling country.

-

Capital gains disposal report

Koinly works with certified public accounts to tabulate how capital gains and losses affect crypto investments and then detail all in a report. Ultimately, it can provide a detailed description of long-term and short-term disposals. Then, depending on the country of filling, it can summarize capital gains and losses while abiding by the local tax laws.

-

Crypto income report

The crypto income report details all the income generated from all crypto holdings, either earned from airdrops, forks, or staking rewards.

It also considers income from various decentralized finance platforms and crypto income transactions.

-

Gifts donations and losses report

Depending on the country, crypto gifts, donations, and losses have a way of impacting the final tax that one is required to pay. Therefore, Koinly can capture all these transactions to give an accurate picture of the final tax position. For instance, Crypto gifts may be treated as capital disposals and crypto donations tax-free and lost cryptos capital loss.

Equipped with all the necessary data and reports as detailed above, Koinly generates detailed crypto tax reports in under 20 minutes. Furthermore, once all the tax filing reports are generated, Koinly makes it easy to preview all capital gains and taxes for free.

For people in the US, the crypto tracker can generate Form 8949 or Schedule D, some of the most important IRS tax forms. The platform also supports international tax reports from Canada to the UK, Germany Sweden, among other countries.

How To Report Crypto Taxes

Equipped with all the crypto tax reports generated by Koinly, it should be much easier to provide all the necessary information that the IRS or any other tax agency requires to compute due taxes.

To report all the crypto tax to the IRS, simply

-

Download and fill out Form 8949 indicating all the taxable cryptocurrency transactions

Form 8949 is used to detail any disposals of assets. In this case, one must indicate all the crypto bought and sold during a financial year. In the form, one must indicate the crypto bought, the price, and all the costs involved. In addition, one must indicate the price and the gain or loss incurred if the assets were sold.

The form is split into two parts. The first part details all crypto bought and sold within a short time, less than a year. Short-term investments are taxed at the normal rate. The second part details all cryptos held and disposed of after one year taxed at a much lower rate.

Include all the net capital gains and losses in Form 8949 on Form Schedule D, including all short- and long-term capital gains and losses.

Schedule D is split into three sections. The first section is for detailing short-term capital gains and losses. The second section is for long-term gains and losses, while the third summarizes the two.

-

Fill Schedule 1

Not all crypto investments are viewed as capital gains and losses. All crypto income from airdrops, forks, liquidity pools, or bonuses should be incorporated in Schedule 1 IRS form. For self-employed people operating crypto businesses and have crypto income, a Schedule C form should be filled out

-

Finally, complete form 1040 and attach all the other forms completed

All the completed forms should be attached to the Individual Income Tax Return form 1040 before the deadline date, April 18th, 2023.

Reliable crypto tax reports

With Koinly, your no longer have to worry about absurd tax gains and inaccurate tax reports that can lead to ridiculous tax bills. Instead, the services are backed by tools that help find the tiniest problems.

Koinly is good at:

- Ensuring double entry ledger system whereby every change in asset balance is backed by a similar entry, therefore able to debug issues

- Detecting any missing transactions due to incorrectly imported data that could cause balances to go to zero

- Importing all the relevant data automatically by checking all the wallets, exchanges, and blockchains via API

- Skipping duplicate transactions, therefore, no need to keep track of data already imported

In the end, the crypto tracker can generate reliable cryptocurrency tax reports such as form 8949 and Schedule D for US crypto investors. It can also generate international tax reports for people in Canada, the UK, and Germany, among other countries.

Koinly pricing

While Koinly tax filing services are available at a fee, it is one of the most affordable in the market. However, its plans depend on the number of transactions it has to process to generate the relevant crypto tax reports.

Source: Koinly.io

For newbies in the crypto market with less than 100 transactions to process the $ 49-a-year tax plan is more than sufficient. The plan offers tax reports in addition to portfolio tracking capabilities

Cryptocurrency Holders of more than 1000 transactions can subscribe to the $99 a-year plan, while traders handling more than 3,000 transactions can subscribe to the $179 plan.

Read more: What Your Non-Profit Needs To Know About Cryptocurrency Donations

Why Koinly for Crypto tax filling

Filing out all the documents as part of the tax filing process can be complex and draining. However, that should not be the case, with Koinly a click away. First, you must import all your crypto transaction history from various wallets, exchanges, and blockchains into API or CSV files.

From there, Koinly calculates all capital gains, losses, income, and expenses. Once everything is done, you only need to open the tax report page on your Koinly account to find the final summary.

Koinly can prepare Form 8949 and Schedule D with all the capital gain losses. It also generates a Schedule 1 form via its Complete Tax Report.

Frequently Asked Questions

How are cryptocurrencies taxed?

In many jurisdictions where cryptocurrencies are taxed, they are viewed as property. Therefore, they are subject to income tax or capital gain tax. The amount of tax one pays depend on the transactions made and whether they resulted in gains or losses. For instance, anytime someone disposes of a cryptocurrency, they must pay capital gain tax on any profits generated from the transaction. There is also a tax on all income generated from cryptocurrency holdings. In the US there is no specific capital gain tax rate on cryptocurrency as it all depends on how long the asset has been held.

Do I have to file taxes if I make losses on cryptocurrency trading?

Cryptocurrency taxes are filed on both losses and gains. Therefore, it does not matter whether one incurred a loss or gain while selling a digital currency. However, reporting losses on cryptocurrency transactions significantly reduces the amount of crypto taxes due in the final compilation.

Can I Avoid paying taxes on cryptocurrencies?

No. It is extremely difficult to avoid paying taxes on cryptocurrency transactions in the US. The internal Revenue Service monitors transactions on exchanges, wallets, and blockchains, making it mandatory to file returns. Every time there is a crypto transfer or a trade, there is a paper trail left behind that the tax authorities use to calculate taxes due.

Are crypto-to-crypto transactions taxed?

Yes, such transactions are due for taxation as they involve the exchange of assets with different values. For instance, if you were to exchange Ethereum for Solana, the tax agency would treat it as a sale of Ethereum at the market price of Solana.

Nevertheless, there is no tax due on transferring cryptocurrency from one wallet to another as long as they belong to the same person. The only thing one must do is keep track of the costs incurred in transferring the coins, as it will be factored into the tabulation.

Can Koinly help in filing the crypto tax?

Yes, Koinly is the go-to platform for anyone looking to enjoy a seamless crypto tax filing process. The crypto tracker collates all the crypto transaction history from wallets, exchanges, and blockchains and computes all the realized and unrealized capital gains and losses. In return, it provides detailed crypto reports that can be filled with the relevant tax agency for tax filing purposes.

Read more: The Fundamentals of Cryptocurrency Trading