The services provided by crypto exchanges allow you to purchase and sell cryptocurrencies and tokens such as Bitcoin, Ethereum, and Dogecoin in a way analogous to how online brokerage platforms facilitate the buying and selling traditional currencies.

Cryptocurrency exchange software development is one of the demanding things in the world of cryptocurrencies. The complete crypto exchange platform depends on the various factors such as supported assets, fees, payment methods, and security should consider when picking a cryptocurrency exchange. We thought of the criteria above when compiling this list of top cryptocurrency exchanges.

Top Bitcoin and Altcoin Markets for November

- Coinbase – Best for Beginners

- Binance.US – Best for Low Fees

- Crypto.com – Best for Security

- BlockFi – Best for Earning Interest

- Bisq – Best Decentralized Exchange

Coinbase: For years, investors had nowhere else to turn but Coinbase, one of the hundreds of cryptocurrency exchanges that have sprung up to serve a demand that the mainstream has ignored. However, the market is developing, and the public is warming up to crypto; the exchange business is hotly contested and threatening leaders like Coinbase.

Since Bitcoin’s inception in 2009, this platform has provided investors with a new option for the digital trading currency that does not list on traditional exchanges. Wall Street may have cleared a path for the latest industry to flourish, but the establishment is warming up to the asset class as Bitcoin soared to over $63,000 in April and other coins and digital assets saw buying frenzy.

For this research, Coinbase comes out on top, followed by other cryptocurrency exchanges based in the United States and Europe that have been around since Bitcoin’s early days but have now been forced to comply with stronger regulations. Some examples are Gemini (based in New York) and Bitstamp (located in London), and Kraken (based in San Francisco).

Binance.US– Did you recently learn about Binance and decide to start trading? Binance is one of the most popular exchanges for trading cryptocurrencies, and it may provide you with a satisfying experience. But to do that, you need to learn how to trade on Binance, which can take a lot of work to do for the first time. Keeping reading our Binance trading tutorial will help you out.

Binance was established in China in 2017 by Changpeng Zhao and Yi He. Both founders spent some time at the OKCoin exchange before deciding it would be more profitable to create their trading platform.

The website can use to exchange cryptocurrencies and digital tokens among itself, as the name implies. More than 500 are available, with some trading alternatives, including Litecoin, Ether, Dogecoin, and Bitcoin.

BNB stands for Binance’s native token, Binance Coin. In 2017, the BNB’s initial coin offering on the exchange brought in roughly $15 million. People who pay their trading expenses with BNB may also be eligible for rebates.

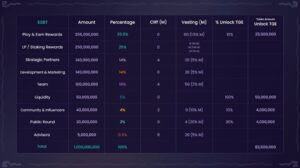

Initial coin offering (ICO) is a popular fundraising method for many businesses. This is because it provides a simple way for crypto businesses to raise capital, bypassing more cumbersome alternatives like bonds and equities.

Crypto.com– Trading cryptocurrencies entails either buying and selling the underlying coins on an exchange or speculating on the price movements of cryptocurrencies using a Contract for Difference (CFD) trading account. Trading contracts for difference (CFDs) are derivatives that allow you to bet on the price swings of cryptocurrencies without owning any coins. If you believe the value of a certain cryptocurrency will increase, you can “go long” (or “buy”), and if you believe the value will decrease, you can “go short” (or “sell”).

Both leveraged instruments allow investors to acquire full exposure to the underlying market with only a little initial investment (the margin). Leverage will increase the magnitude of your gains or losses, depending on how they calculate relative to the total size of your position.

Read more: How To Choose A Cryptocurrency Exchange In 2022?

The cryptocurrency market is decentralized since a government does not issue or guarantee cryptocurrencies. It’s a computer network they’re running across. On the other hand, cryptocurrency can be traded for other currencies and kept safe in digital wallets.

Cryptocurrencies, in contrast to fiat currencies, are not physically minted but exist only as a shared digital record of ownership on a distributed ledger called a blockchain. A digital wallet is where bitcoin units are stored when sent from one user to another. After verification and addition to the blockchain, the transaction is declared complete through a process known as mining. This process does use to generate brand-new tokens for use in cryptocurrency networks.

BlockFi: The world’s first cryptocurrency rewards credit card, BlockFi Rewards Visa® Signature Card, was released on July 6, 2021, by BlockFi, a crypto financial services company dedicated to promoting financial inclusion and expanding worldwide access to the crypto economy.

How did we get the news to the crypto community and the general public? By creating an engaging multimedia campaign to create a welcoming environment for crypto investors.

Since the program’s inception, we’ve provided cardholders with various exciting opportunities to increase their reward points simply by interacting with us on social media. We love expanding our network and giving back, so we’re always looking for unique ways to reward our members, such as purchasing them coffee for tweeting a photo of their morning brew with the hashtag #BlockFIGotThis.

In our video series about the world’s first crypto rewards credit card, we utilize humor and everyday situations to help consumers picture Bitcoin’s value and the card’s benefits. Our most popular advertisement, “I Got This,” explained in plain English why two friends at a restaurant would argue over who should pay the bill if they could instead split their bitcoin buy by up to 3.5 percent.

Our strategy for managing risk centers on maximizing risk-adjusted returns, which helps us meet our long-term goals without jeopardizing our clients’ interests. We’ve hired Yuri Mushkin, CFA, a 20-year veteran of Goldman Sachs and McKinsey, to head up our new, standalone Risk Management department.

Yuri does backed by a staff of expert risk managers, each of whom has more than 15 years of experience at top financial organizations, including Goldman Sachs, Morgan Stanley, Bank of America, Citibank, and others. The crew has been through several severe financial crises, including the Great Recession of 2008–2009, the European debt crisis of 2011–2012, and the COVID–triggered catastrophe of 2020.

Bisq- Bisq is a distributed cryptocurrency exchange built on the Bisq Trade Protocol and the Bisq DAO (decentralized autonomous organization). The Bisq DAO decentralizes the exchange’s governance and financial activities, while the Bisq Trade Protocol streamlines Bitcoin’s peer-to-peer trading for other currencies. However, by adhering to the Bisq Trade Protocol and participating in the Bisq DAO, members must broadcast extra data to the Bisq peer-to-peer network and publish data to the Bitcoin blockchain. We take a look at the participants’ potential loss of privacy as a result of this sharing. To build the one-to-many mappings from participants to Bitcoin blockchain addresses, we employ unique address clustering techniques and supplement the address clusters with information held in the Bisq peer-to-peer network. Here, we detail the methods we developed for clustering Bisq DAO and Bisq Trade Protocol addresses. We demonstrate that the heuristics sum the actions taken by all users, including purchases, votes, and transfers. In rare cases, we can determine that a given person is using a combination of fictitious and real names online. We isolate the key transacting parties and analyze their function inside a bilateral market. We conclude with future recommendations for participant privacy enhancement.

Since Bisq is a decentralized cryptocurrency exchange, it falls under the jurisdiction of blockchain analysis service providers. However, unlike other centralized cryptocurrency exchanges, it does not require identity checkpoints to conduct business. In this piece, we examine the Bisq Trade Protocol and the Bisq DAO (decentralized autonomous organization) from the privacy perspective. These two parts of Bisq are responsible for decentralizing the governance and finance functions of the entire exchange, respectively, and for systematizing the peer-to-peer trading of Bitcoin for other currencies. We demonstrate that engaging in Bisq trades and using the Bisq DAO comes with a high price in terms of personal privacy.

As a Closing Remark

Bitcoin (BTC) investing is not dissimilar to stock market investing. To trade Bitcoin, you must join an exchange. When dealing with stocks, opening an account with a brokerage is necessary. After that, you must add funds.

The only difference is that before you can trade Bitcoin, you must use your deposited funds to buy Bitcoin. Bitcoin (BTC) purchases are starting trades, but they will not count until you actually spend the money.

Check out: Beginner’s Guide To Launch A Cryptocurrency Exchange Like Coinbase