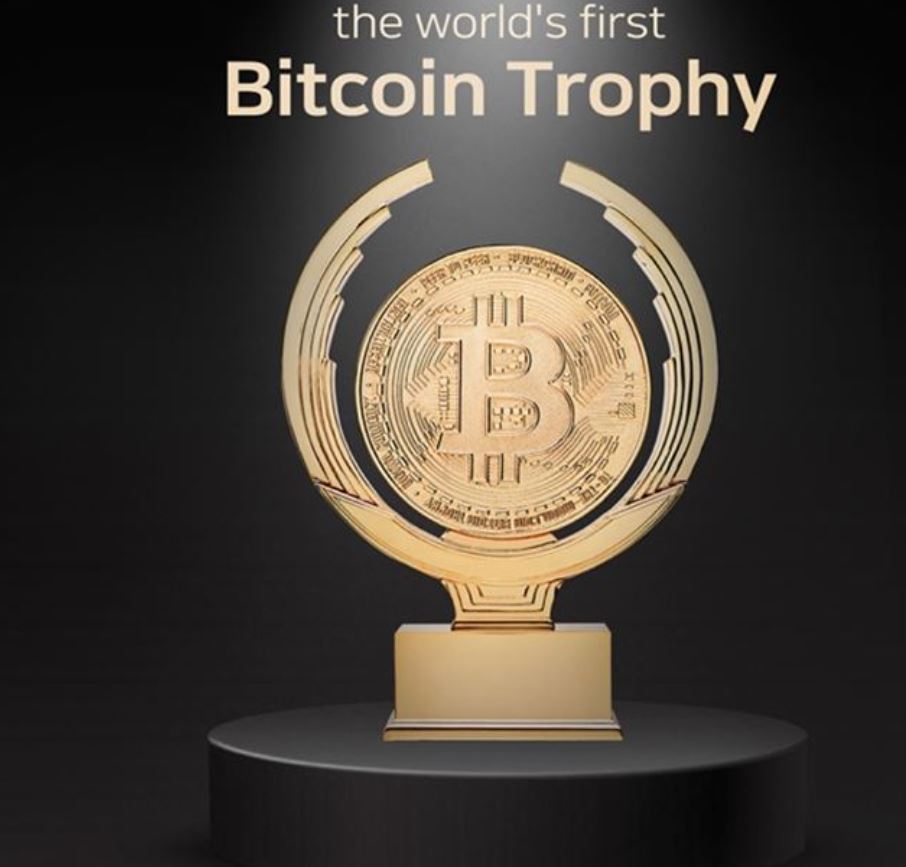

Picking a gift for a loved one, mentor, employer or anyone couldn’t be better. If a cryptocurrency gift is what you are planning to buy, then go for the Bitcoin Trophy.

The Bitcoin trophy is a symbol of prestige and luxury. It gives credence to all players in the market. For holding, long or short selling and awaiting entry, it is a perfect item. The BT serves as a symbol of dreams. You are motivated to reach your trading goals. With the symbol in possession and the target pinned down, you are constantly reminded.

This picture-perfect item is built to last, with its durability features. An exquisite marble and gold finish on a solid metal is its appearance. A beautiful item for people of repute.

Opportunities to offer Bitcoin Trophy

There is always something to support, appreciate, or celebrate. This always offers opportunities to give gifts. Choosing a gift for certain personalities can be tasking. Just let them know they are valued without going overboard. The Bitcoin Trophy is an ideal item to achieve this.

Gift for mentors and top players

Joining the league of big players might just be easy with a gift like the Bitcoin trophy. You only need to engrave something extraordinary to show you possess a great mindset. A motivational quote, goodwill message or even a name can do the magic.

Motivating Partner support

Gifting a Bitcoin Trophy to your partner is the best way to show support. Nothing spices a relationship more than to know your lover cares and supports your activities. You can boost their morale times two with a presentation of a BT.

This singular act may be all the motivation they need to pursue their goals.

Amazing Giveaways

Everyone loves the concept of a giveaway. Since gifts are a way to show appreciation, gratitude and love, then give Bitcoin Trophy. Such an item will endear you in the heart of the received and invariably strengthen bonds. Look for opportunities to do give-aways and become the darling of everyone.

Special Holiday gift item

Christmas, Valentine, birthdays and other holidays are a perfect opportunity to give Bitcoin Trophy. No-fuss about what to give out, BT is glam.

Employee gifting idea

Corporate gifting is usually valuable to the recipient. Employees feel special and honoured at such gestures. As a way of appreciating the staff, give the Bitcoin trophy as one.

Note bosses don’t always expect gifts from subordinates. As an employee why not surprise your boss with a BT on any special gift exchanging event.

Client Appreciation gifts.

Ever consider how best to appreciate a long time and committed client? Why not customize a Bitcoin Trophy and let them know you are grateful for doing business with them? This will bring about a closer business relationship.

Inspirational Retirement gift

Trophies are treasures and a Bitcoin Trophy is no exception. BT is an appropriate gift for someone who is retiring from an organization. Engrave lovely words to summarize their service. You are sure to watch the retirement dab the tears in the eyes. A gift such as this will make leaving the company less painful.

The above is a round-up of a master list of opportunities to give Bitcoin Trophy. Ensure your giving is smart going forward. The BT offers an easy way to be thoughtful and impactful in your giving. A perfect item for professional as well as personal gift presentation.

Years of knowledge in craftmanship

To-the-moon is South-Korea-based company regarded as the premium source for high-quality, custom-made Bitcoin trophies. They cater to all forms of stakeholders within the cryptocurrency spectrum; you don’t have to be a veteran trader to be the owner of our high-grade and luxurious trophy.

Their main objective is to cater satisfactorily to all Bitcoin and cryptocurrency lovers both home and abroad.

To-the-moon ships everywhere (if you are on the moon, let them know too!). After placing your orders, expect that your Bitcoin trophies will ship out within two business days. They also have a 100% happy return policy, and you may return any of their products within 14 days of the receiving date. They provide a money-back guaranteed.

Get your Bitcoin Trophy and become one of the few trophy hodlers on your journey to the moon.